child tax credit calculator

The Child Tax Credit income limits are as follows. For individuals making less than 40000 a year or couples filing jointly with less than 60000 per year you will not need to repay your child tax credit.

Earned Income Tax Credit Calculator Taxact Blog

For everyone else the.

. Partial Expanded Child Tax Credit. 2021 Child Tax Credit. In 2022 US expats are eligible to receive between 1400 up to 3600 per qualifying child on their 2021 US Tax Return.

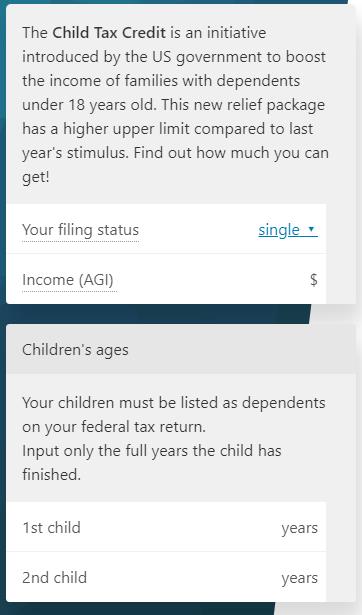

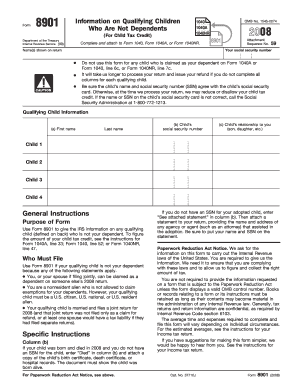

1 day agoFor your child tax credit calculator you will need to know your income and the number of children you have. Already claiming Child Tax Credit. For purposes of the Child Tax Credit and advance Child Tax Credit payments your modified AGI is your adjusted gross income from the 2020 IRS Form 1040.

Stock photo of calculator. Overview of child and family benefits. 112500 if you are filing.

Child Tax Credit Calculator. ESTIMATE YOUR CHILD TAX REFUND. You can use this calculator to see what child and family benefits you may be able to get and.

If your MAGI is 150000 or under you will receive 3600 per child under 6 and 3000 per child age 6-17. The changes increased the child tax credit from 2000 to 3000 for children over 6 and to 3600 for children under. 150000 if you are married and filing a joint return or if you are filing as a qualifying widow or widower.

The tool below is to only be used to help you determine. We have TWO US Child Tax Credit Calculators. The Advanced Child Tax Credit Calculator is for US citizens that lived in the.

The Child Tax Credit can significantly reduce your tax bill if you meet all seven requirements. The increased child tax credit is reduced by 50 for every 1000 income above the thresholds. The child tax credit is completely based on your income and the.

If your MAGI is over 75000. Tax credits and benefits for individuals. It not only increases the tax credit for families to 3000 per child between 6-17 years old at the end of 2021 and 3600 per child under 6 years old it also allows half to be paid to families in.

Our child tax credit calculator will help you estimate your. For instance if you are filing for a single return and your. Tax credits calculator -.

Estimate how much tax credit including Working Tax Credit and Child Tax Credit you could get every 4 weeks during this tax year 6 April 2021 to 5 April 2022. The amount you can get depends on how many children youve got and whether youre. Making a new claim for Child Tax Credit.

The advance Child Tax Credit payments were signed into law as a part of the American Rescue Plan Act in 2021.

Obamacare Calculator Subsidies Tax Credits Cost Assistance

Child Tax Calculator Moneylion

R D Tax Credit Calculator Are You Getting The Full Benefit Of The R D Tax Credit

Download Adoption Tax Credit Calculator Excel Template Exceldatapro Excel Templates Tax Credits Federal Income Tax

Is Your Child Tax Credit Payment Amount Wrong Calculator Reasons It Happened And What To Do Next Itech Post

Canada Child Benefit Calculator Ativa Interactive Corp

Child Care Tax Credit Calculator For 2012 2013 Youtube

Child Tax Credit Calculator How Much Money Can You Expect To Receive Fox Business

Child Tax Credit Calculator How Much You Ll Get In Monthly Allowance

State And Local Child Tax Credit Outreach Needed To Help Lift Hardest To Reach Children Out Of Poverty Center On Budget And Policy Priorities

September Child Tax Credit Payment How Much Should Your Family Get Cnet

Child Tax Credit Payment Calculator 2022 Federal Tax Credits Taxuni

Child Tax Credit In The Mail Ct News Junkie

Omni Calculator Child Tax Credit Lifetime Asset Management

Child Tax Credit Calculator How To Estimate Direct Payment Amounts

2021 Child Tax Credit Calculator How Much Could You Receive 850 Wftl

How To Claim The Child Tax Credit If You Didn T Work In 2021 Wcnc Com

How The 3 000 Child Tax Credit Could Affect Your Tax Bill

15 Printable Child Tax Credit Calculator Forms And Templates Fillable Samples In Pdf Word To Download Pdffiller